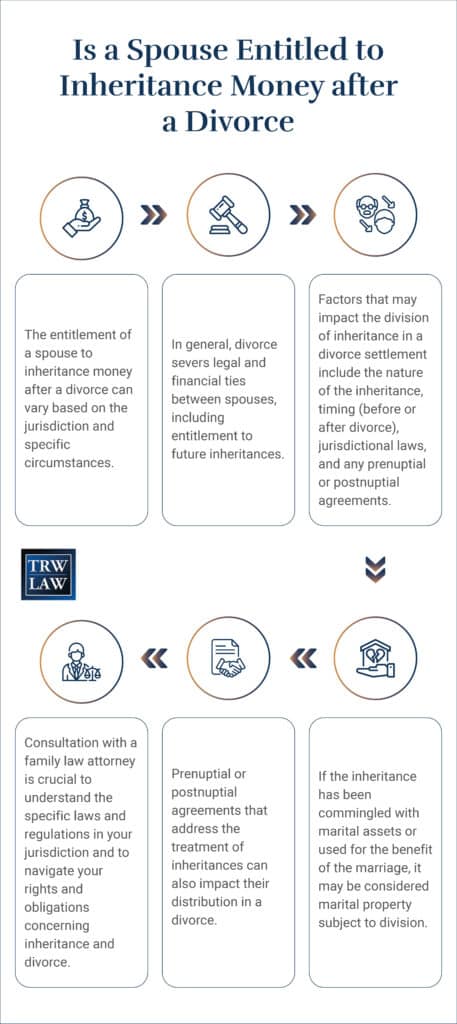

- Divorce and Asset Division: Divorce involves complex issues like asset division, including inheritances. Whether a spouse is entitled to the other’s inheritance depends on various factors and legal circumstances.

- Understanding Inheritance: Inheritance typically refers to assets received following a family member’s death, which can include cash, real estate, investments, or personal belongings.

- Treatment of Inheritance in Divorce: In Florida, inheritances are generally considered separate property, not subject to division during divorce. However, there are exceptions and circumstances where inheritances may be subject to division.

- Property Division Laws: Different states have different property division laws, such as community property or equitable distribution principles. Understanding these laws is crucial in determining the treatment of inheritances during divorce.

- Commingling of Assets: Commingling occurs when separate property, like an inheritance, is mixed with marital assets. This can complicate the classification of assets and potentially subject the inheritance to division.

Divorce is a complex and emotionally challenging process. One of the most emotionally charged issues is the division of assets and property. One aspect that requires attention is the treatment of inheritances during divorce proceedings. Is a spouse entitled to the other spouse’s inheritance? In many cases, the answer depends on the circumstances.

At the Law Offices of Travis R. Walker, P.A., we provide compassionate and efficient legal assistance to you during one of your life’s most challenging and difficult times. You can count on our team to always protect your interests. We have won thousands of cases and earned glowing client testimonials. Our dedicated professionals can help you understand all the potential consequences of a divorce—including whether it will affect your inheritance—so that you can make the best-informed decisions.

Understanding Inheritance

Generally, inheritance refers to assets or property transferred to an individual following a family member’s death. These assets can take many forms, including:

- Cash

- Real estate

- Investment holdings

- Personal belongings

Florida does not require couples to follow any specific guidelines to file for divorce. However, one spouse must be a state resident for at least six months to take advantage of the divorce laws. Since Florida is a no-fault state, one partner can file for divorce if the marriage is considered irretrievably broken. During this process, couples may wonder if their inheritances are protected from property division.

Depending on where the divorce paperwork is filed, an inheritance may be treated as separate or as marital property subject to division. Some states follow equitable distribution principles, meaning marital assets and liabilities are divided fairly—though not equally—between spouses during a divorce.

In Florida, an inheritance received by one spouse is considered separate property, meaning it belongs solely to the recipient and is not subject to division during divorce. However, there are circumstances in which inheritance funds or assets can lose their status as separate property and become subject to division.

Divorce and Property Division

When considering property division during a divorce, you must understand the difference between marital and separate property. Typically, marital property includes assets acquired during the marriage, such as a shared home and joint bank accounts.

On the other hand, the spouses’ separate property encompasses assets owned before the marriage or acquired through inheritance or gifts. By differentiating between the two types of property, you can determine how the inheritance will be treated.

Common Approaches to Property Division

When going through a divorce, you must consider how property division works in your jurisdiction. Some states follow community property laws, which means that assets acquired during the marriage are divided equally.

Some states, such as Florida, follow equitable distribution principles that account for various factors to determine a fair division of assets. While that may mean a 50/50 split, the distribution may not be equal if a judge rules it is unfair to one of the spouses.

Inheritance as Separate Property

Separate property refers to assets owned individually by one spouse and not subject to division. When dealing with an inheritance, this property classification depends on several factors.

Florida generally designates an inheritance as separate property, no matter whether a spouse received it before or during the marriage. However, there are exceptions.

The actions of the recipient spouse affect how an inheritance is treated. If these assets are kept separate from joint assets, they will be considered separate property. However, if the spouse mixes the inheritance with marital assets, such as a joint account, it may become subject to equitable distribution in the divorce.

For example, if you inherited money during the marriage but kept it in your own separate account throughout the marriage, that money will likely be classified as separate property. On the hand, if you inherited a family heirloom during the marriage and displayed it in your home, it might be subject to division based on the court’s interpretation.

Commingling of Inheritance and Marital Assets

When does an inheritance become marital property? Commingling refers to mixing separate property with marital assets. When inheritance funds are combined with joint bank accounts or used for shared expenses, it can complicate the classification of those funds during a divorce.

Commingling can blur the lines between separate and marital property, potentially leading to the inclusion of inheritance in the division of assets. To protect an inheritance, you must maintain separate accounts and have documentation distinguishing it from marital assets.

Commingling can also be very subtle. For instance, a spouse may keep inherited funds in an account under their name alone. However, if they allow their spouse to access the account, the funds may become marital assets subject to equitable division even though the spouse’s name is not on the account.

Another type of commingling is when the inheritance is used to enhance or grow marital assets. On the other hand, using marital assets to improve an inherited asset may also be deemed commingling. In either case, a court may deem all or a a portion of the inheritance as marital property subject to division.

Court discretion can also come into play when there are fairness and equitable distribution issues. Even if the inheritance is classified as separate property, the court has the authority to adjust the division of assets to achieve a fair outcome. This process could involve allocating a larger portion of other marital assets to the spouse who did not receive the inheritance to balance the overall property division.

Jurisdiction and Legal Variations

The treatment of inheritance in divorce cases can vary significantly based on the jurisdiction and its laws. Countries or states may have specific laws and regulations governing property division during divorce.

Even if you’re located in Florida, you may still want to understand the various legal approaches followed in other potential jurisdictions to determine the impact on the inheritance. Some states, such as Pennsylvania, even place a tax on inheritances. With that in mind, you must know the potential consequences of receiving and protecting an inheritance during a divorce.

Consulting a family law attorney specializing in local laws can provide valuable guidance and ensure compliance with jurisdiction-specific regulations.

Prenuptial and Postnuptial Agreements

One way to protect inheritances from property division in a divorce is to sign a prenuptial or postnuptial agreement. These legal agreements establish clear guidelines for property division, including how to handle inheritances in the event of divorce.

By outlining the property statuses and defining the rights and responsibilities of each spouse, these agreements can help safeguard inheritance rights. You will want to consult a divorce lawyer to draft and review these agreements to ensure they comply with local laws.

Seeking Professional Advice

With the complexity and variability of divorce and inheritance laws, anyone with an inheritance should seek professional advice to protect their rights. A knowledgeable attorney can:

- Explain the local laws

- Assess the implications of inheritance

- Offer strategies to protect your rights and assets

Reach Out to a Florida Family Law Attorney

Inheritance and divorce are complex topics that require a thorough understanding of the possible legal implications. In any case, it is important to differentiate between marital and separate property, especially when trying to protect an inheritance.

Is a spouse entitled to inheritance money? At the Law Offices of Travis R. Walker, P.A., we are ready to answer divorce questions about real estate and asset division, trust litigation, and child custody. We are committed to guiding you through every step of your legal journey and achieving the optimal resolution for your case. Contact us today by filling out our online form or calling 772-708-0952 to schedule a consultation.