Irrevocable trusts are attractive estate planning tools when you have assets to protect, but serious financial risks exist. It’s important to seek personalized legal counsel before permanently changing your estate. At the Law Offices of Travis R. Walker, P.A., we’ll help you understand the pros and cons of irrevocable trusts and how they apply to you.

In an unpredictable economy, protecting your loved ones’ financial futures is more important than ever. Irrevocable trusts are tools used in the estate planning process. People often choose irrevocable trusts to safeguard their assets and possibly secure tax benefits, but the advantages don’t always outweigh the drawbacks.

If you’re considering an irrevocable trust as part of your estate plan, our skilled attorneys can help. At the Law Offices of Travis R. Walker, P.A., in Palm Beach, Florida, we’ll help you understand the pros and cons of irrevocable trusts and how they impact your unique situation.

Advantages of Irrevocable Trusts

An irrevocable trust can add essential value to an estate planning strategy. When used well, it offers protections unavailable through other means. Consider the following irrevocable trust benefits:

- Asset protection. Placing assets in an irrevocable trust shields those assets from creditors—both the grantor's and the beneficiary's. Trust assets are also out of reach in lawsuits, as they belong to the trust, not the guarantor or beneficiary.

- Tax benefits. If an asset enters an irrevocable trust, it becomes separate from the grantor's taxable estate. It is no longer subject to federal estate tax when the grantor dies.

- Control over distribution. When you set up an irrevocable trust, you may specify how the beneficiary uses those assets. For example, you may mandate that the money be used to fund an education or support a family member with special needs.

- Privacy. Unlike a will, a trust is a private document. A will becomes part of the public record during probate, but a trust is exempt from the probate process. No one outside the trust can access information about your asset distribution plan.

Despite these advantages, an irrevocable trust isn’t suitable for everyone. Consider irrevocable trust pros and cons before making a final decision.

Disadvantages of Irrevocable Trusts

An irrevocable trust is highly restrictive and inflexible by nature. Before making your decision, be aware of these irrevocable trust drawbacks:

- Loss of control. When you place assets in an irrevocable trust, the transfer of assets is permanent. You no longer have an interest in or control over those assets. The assets now belong to the trust, and the trustee must manage them according to its terms. You cannot change those terms or access the assets for any other purpose.

- Complexity and costs. The language of an irrevocable trust must be precise to protect the grantor's interests. Generally, the more complex a legal document, the more costly it is to prepare. The federal estate tax exemption exceeds $12.9 million as of 2023, so it may not be worth the cost.

- Irrevocability. Once the assets are transferred into the trust, the grantor cannot undo the transfer or revoke the trust. Specific circumstances may allow designated parties to change specific trust provisions, but control does not revert to the grantor. The terms of a trust must precisely reflect your wishes before you finalize it with your signature.

- Potential Tax Implications. Assets in an irrevocable trust are subject to taxes, including taxes on asset-produced income. Depending on the trust's structure, the trust or the grantors may be responsible for those taxes. Certain trusts may have additional tax considerations, especially if there is at least one generation between the grantor and beneficiary.

If you’re considering an irrevocable trust, you need a skilled attorney to ask you the right questions and help specify your wishes. Skilled legal advice, such as that from our experienced attorneys, is essential to this process.

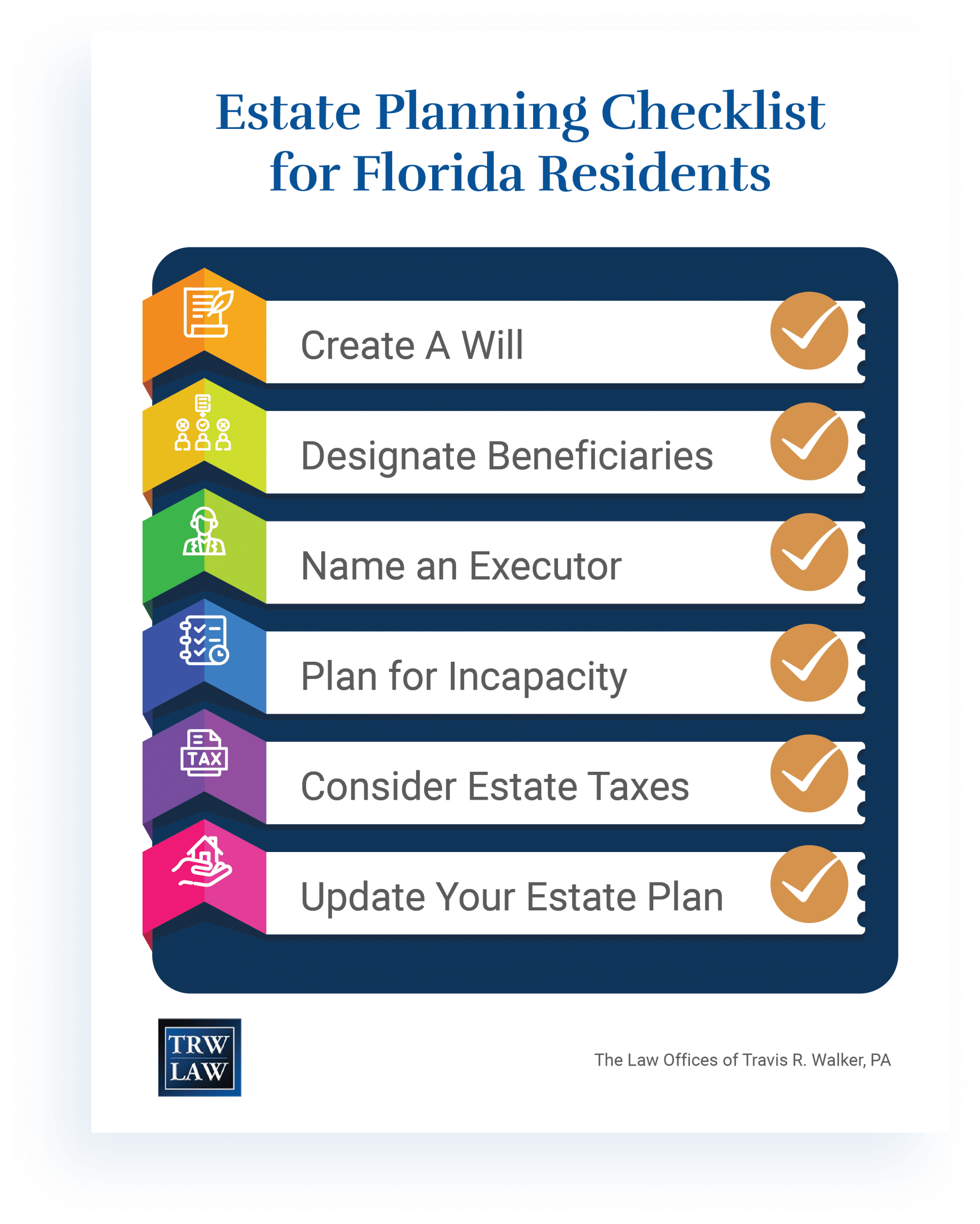

Considerations for Florida Residents

Trust statutes vary by state and can significantly affect financial outcomes for grantors and beneficiaries. In Florida, for example, an irrevocable trust may not have protection from the beneficiary’s creditors unless the trust includes a “spendthrift provision.”

The spendthrift provision restricts the transfer of a beneficiary’s trust interest. For example, suppose you leave $100,000 in trust to your adult child. After your death, they default on their mortgage and owe the lender $75,000. If the trust has a spendthrift provision and the trustee has not distributed the funds to that beneficiary, the creditor cannot take possession of the trust’s assets.

Another critical Florida statute is the discretionary distribution provision. This rule allows the trustee to make non-standard distributions to the beneficiary, provided they act “in good faith and within the limits of the sound execution of the trust.”

A trustee’s level of allowed discretion depends entirely on the trust’s terms. Some trusts allow for basic discretion in certain circumstances, while others offer the maximum discretion permitted by law.

One word in a trust’s language can make a difference. State-specific legal advice is essential.

Who Should Consider an Irrevocable Trust?

You may benefit from a charitable trust if one or more of the following apply:

- Your assets exceed the federal estate tax exclusion. Florida has no estate tax, but state residents are still subject to the federal tax. Grantors with assets above the federal exclusion may create a trust to reduce their taxable estates.

- Your beneficiaries receive government assistance. Social security income has a firm asset limit, currently set at $2,000 for an individual. Placing the person's inheritance into a trust can protect their ability to receive benefits.

- You are active in a profession vulnerable to lawsuits. Creating an irrevocable trust can protect your legacy from seizure through judgments and verdicts. Consulting with an attorney is essential if you plan to use this strategy.

Irrevocable trusts may be appropriate in these scenarios, but individual circumstances may call for other solutions. Likewise, grantors who don’t fit these profiles may need irrevocable trusts for different reasons.

For example, if you’re entering a marriage, you may consider an irrevocable trust to protect your assets from a potential divorce. That decision depends on your financial and legal circumstances, which only a licensed attorney can accurately analyze.

Personalized legal advice is essential for anyone considering an irrevocable trust. Trust the attorneys at the Law Offices of Travis R. Walker, P.A., to provide that counsel confidentially and with expert knowledge of estate planning.

How the Law Offices of Travis R. Walker Can Help

At the Law Offices of Travis R. Walker, P.A., we understand the importance of estate planning in safeguarding your family’s future. Our skilled attorneys have helped many clients create and manage trusts, including numerous irrevocable trusts.

Client testimonials describe our trusted team as insightful, professional, and invaluable. We’ll help you decide whether an irrevocable trust is right for you and, if not, what type of estate planning vehicle would be more appropriate. Our extensive experience allows us to offer relevant estate planning advice based on each client’s wishes, needs, and finances.

Our experienced attorneys are here to walk you through the steps of estate planning and guide your decisions.

Irrevocable Trust Pros and Cons: Making the Right Decision

Forming an irrevocable trust is a significant decision you can’t undo. It’s essential to fully understand the pros and cons of irrevocable trusts so you can apply that understanding to your unique situation.

Professional guidance is necessary to make a truly informed decision. The experienced attorneys at the Law Offices of Travis R. Walker, P.A., understand Florida law as it applies to irrevocable trusts. We’re here to walk you through the steps of estate planning and guide your choices.

Make the best possible decision for your future and your loved ones. Contact us today to schedule a consultation.