The landscape of condominium ownership in Florida has undergone seismic shifts in recent years, primarily driven by major legislative reforms intended to improve building safety and financial stability. For many condo owners, this reform era has manifested in the form of substantial and often unexpected special assessments. Navigating these condo association disputes requires a clear understanding of the new laws, as well as the fundamental owner rights provided under Chapter 718 of the Florida Statutes.

The issue of special assessments is rarely just about the immediate bill; it’s about the association’s long-term financial health and adherence to the law. Since the 2021 Surfside tragedy, new requirements for structural integrity and reserve funding have made mandatory reserves for specific structural components—such as roofs, foundations, and load-bearing walls—no longer waiverable for most buildings three stories or higher.

The New Reality: Mandatory Reserves and Structural Assessments in Florida

Mandates like the Structural Integrity Reserve Study (SIRS) and Milestone Inspections, primarily governed by laws like SB 4-D and the subsequent refinements in HB 913, directly fuel the need for special assessments. These laws require associations to identify and fully fund future repairs for critical items, often leading to large assessments for communities that chronically underfunded their reserves. The deadline for completing the initial SIRS has recently been extended to December 31, 2025, but the requirement to fully fund these structural reserves remains a priority for associations, especially those in high-risk areas like South Florida.

Associations now have more flexibility in funding methods—including lines of credit and loans—but the imposition of any significant special assessment to fund reserves usually requires the approval of a majority of the total voting interests of the association.

Challenging Special Assessments: Your Rights as a Florida Condo Owner

As a unit owner, you have defined owner rights when faced with a special assessment that seems excessive, unreasonable, or improperly imposed. A special assessment can potentially be overturned on legal grounds if the association failed to follow the proper procedure, such as not providing the required 14-day notice for the board meeting where the assessment was adopted.

Other common grounds for challenging an assessment include:

- Lack of Justification: The assessment amount is found to be unreasonable or excessive relative to the actual costs.

- Violation of Governing Documents: The association violated specific procedural rules or spending limits set forth in its own declaration or bylaws.

- Missing Owner Approval: The assessment funds a material alteration to the common elements that requires membership approval (often 75%), but that approval was never obtained.

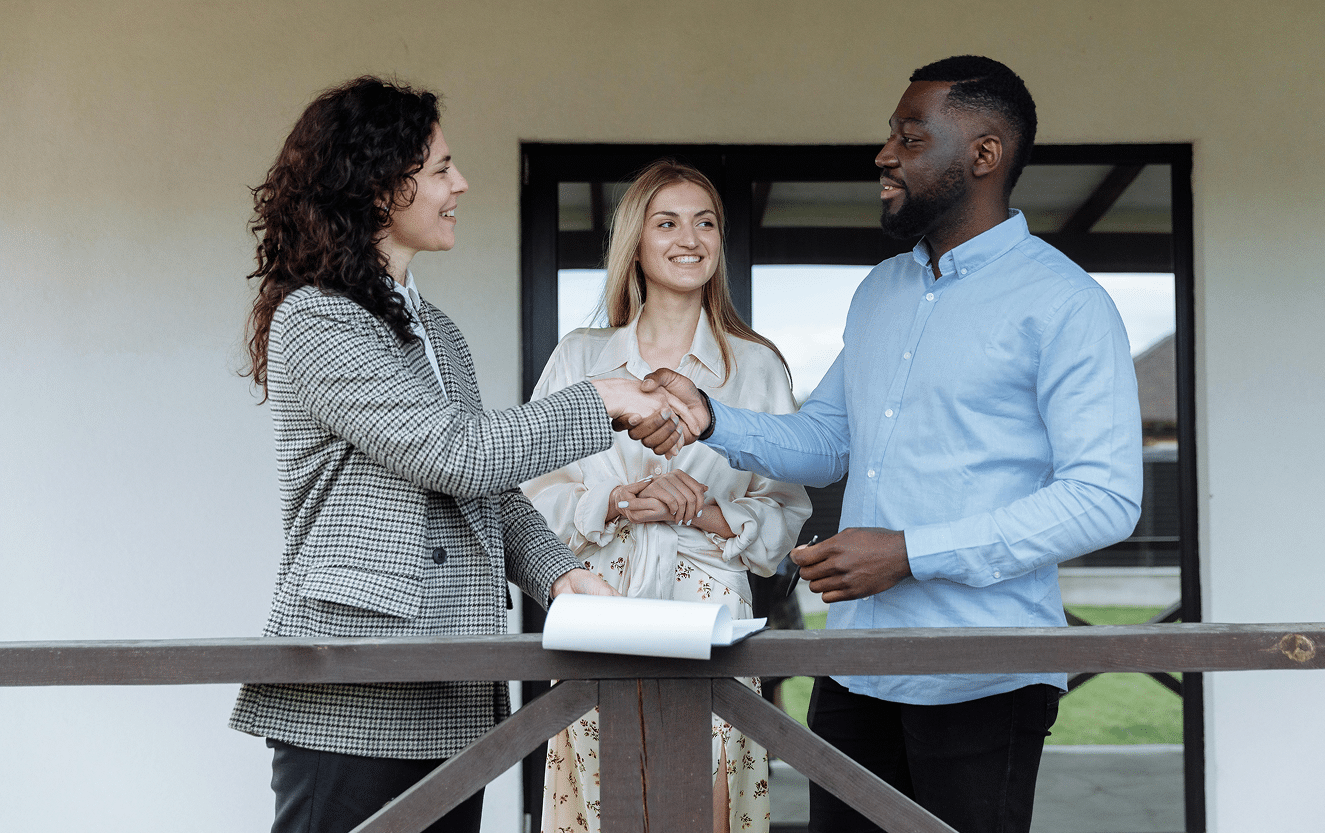

If you believe a levy is improper, it is crucial to review your association’s governing documents and request all relevant financial and engineering reports. While pursuing a legal challenge, owners may choose to pay the assessment under protest to protect their property from a lien or potential foreclosure while preserving their right to recover the funds if the challenge succeeds. When facing a substantial or questionable special assessment, consulting a legal professional experienced in condo association disputes is the necessary first step to evaluate your rights and the board’s compliance with Florida law, such as Florida Statute §718.112 (external link: Florida Statutes).