Probate Attorney in Stuart

Probate is a complex area of law that requires specific knowledge of the laws and procedures, as well as how to handle the complicated problems that can arise. Seemingly small mistakes can create large problems and even expose the administrator to liability. Choosing an experienced Martin County probate attorney is an important step to seeing the administration through properly.

Our Probate Attorneys

Our team at the Law Offices of Travis R. Walker, P.A. offers two distinct probate services. We offer probate services tailored to individuals and families who are dealing with a deceased individual’s estate plan or personal injury case as well as probate services specifically for attorneys who need executors or local counsel to assist with estates.

“Probate can be a labyrinth of legalities, but trusts provide a strategic shortcut, bypassing the process altogether. With careful planning and legal guidance, individuals can maintain control over their assets and ensure a seamless transition for their beneficiaries.”

-Travis R. Walker | Founder and Philanthropist

What Is Probate?

Probate is the court process for validating and carrying out a will. Not all of a deceased individual’s assets will become a part of the probate estate. Depending on factors like whether the will is contested, the unique nature of probate assets, and unusual claims, probate can be wound up quickly or continue for an extended period. On average, it takes about six to nine months, and in most cases an attorney is required to represent the estate.

The probate process in Florida requires several steps:

- Order death certificates

- File the will in Florida probate court

- Appointment of an executor or personal representative of the estate

- Gather and appraise property

- File final tax returns

- Settlement of debts and distribution of assets

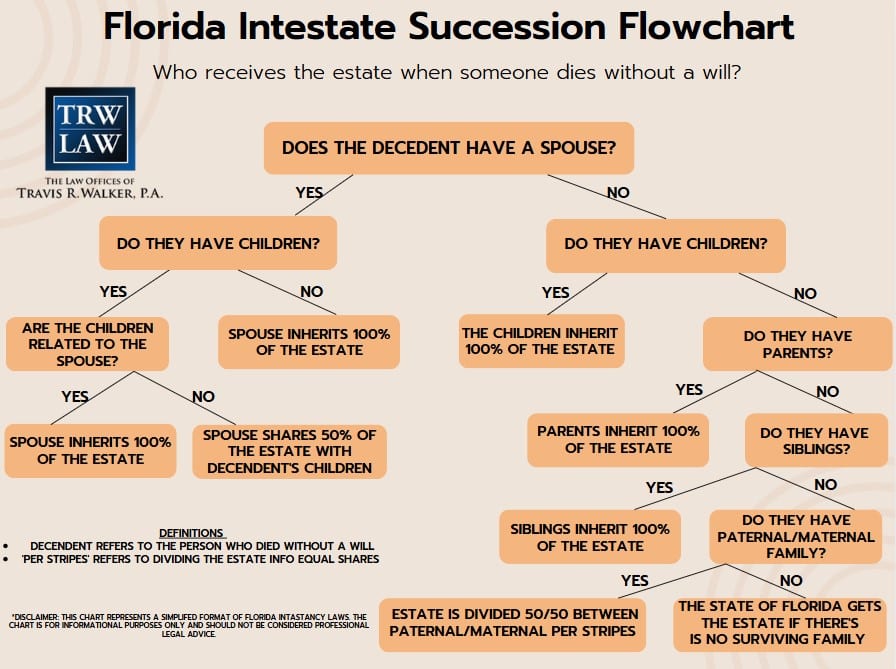

In the State of Florida, the Court is involved in this process to ensure that either the will or Florida law is carried out in distributing the assets and addressing liabilities. If the loved one died without a will, probate in Florida follows a different but similar process; a probate lawyer can help you through what is known as an intestate probate administration.

No matter how complicated the case may be, a skilled attorney is an indispensable resource. Our firm is prepared to guide you through the process.

Probate Work for Individuals

No two probate administrations are exactly the same; they can arise in different manners, involve different interpersonal dynamics, and raise novel legal and practical questions. In many cases, a loved one passes on and leaves his or her estate behind. The individual’s estate then goes into “probate” before the individual’s assets are addressed and/or disbursed. This is when an attorney steps in.

Even if your loved one left a will with specific instructions on what to do with their debts and assets, the act of carrying out those wishes can be extremely time-consuming and burdensome, especially while you are also grieving. Having an experienced attorney on your side to guide you can help make the process as easy as possible.

Probate Work for Attorneys

There are many reasons why other fellow attorneys reach out to us for probate work. They may practice law in another jurisdiction and need local counsel to appear in probate court or want to have an executor who is familiar with local resources to help with the valuation or selling property.

The legal team at Travis Walker can serve as local counsel and as a liaison between other counsel and the probate court. We can also serve as an executor in probate matters in this area. Our team has access to local resources throughout the Stuart, Florida, and Palm Beach, Florida areas that may not be available to you otherwise. Our team can be an invaluable resource to your clients or even to you personally.

Special Issues Can Arise During Probate

Complicating factors to a probate administration may be expected or unexpected but they need to be addressed with skill by an experienced lawyer. Some of the special issues that can arise include:

- Personal injury claims – If the deceased person had a valid personal injury claim at the time of death, Florida law permits the claim to go forward. A personal injury lawsuit against the estate of the deceased may also continue after death. However, there are special procedural steps that the personal representative of the estate must follow to comply with civil procedure and probate rules.

- Valuing unique property – Determining an accurate value of an estate is necessary to determine whether estate taxes will be assessed and if so, how much. It can also impact how property is distributed among beneficiaries. Special items, including art, collectibles, intellectual property rights, and digital assets, can require an expert opinion but rules affect who is qualified to act as an appraiser.

- Breaches of duty – The personal representative of an estate is under a fiduciary duty to act in the best interest of the beneficiaries. When this does not happen, the beneficiaries may have a claim for breach of fiduciary duty against the representative. If the dispute involves fraud, duress, or similar wrongdoing, it may amount to tortious interference with inheritance.

- Will contests – In Florida, an “interested person” – including heirs, beneficiaries, and creditors – can contest the validity of the will. The most common grounds for contest are that the person making the will lacked capacity, that the will was executed when the person making it was under undue influence, or that the will did not meet the required legal formalities to be valid in Florida. This can even lead to probate litigation.

- Inheritance by minor children – Parents and grandparents often prefer to name minor children as beneficiaries under a will but Florida law limits how much money a minor can receive directly. The parents of a minor to whom up to $15,000 has been left may receive the money on the child’s behalf but an amount of $15,000 or more must go through a guardianship proceeding. It is important to speak with a family law attorney in Stuart, FL to ensure that any inheritance by a minor complies with the law.

Not all probate problems are foreseen but many can be avoided through competent estate planning and an understanding of Florida probate administration. Our firm can help you spot potential issues and effectively address those that emerge during administration.

How The Law Offices of Travis R. Walker Can Help

The probate process can be very daunting for anyone unfamiliar with it. You do not have to go through this process on your own. Regardless of your probate needs, whether you are an individual or an attorney, the Law Offices of Travis R. Walker, P.A. can provide a helping hand guiding you through what you need to do to save time and headaches during a difficult period.

Your Three Steps to Moving Forward

Call our office or complete our contact form and set up an intake call with our Intake Coordinator.

Attend a virtual or in-office consultation so we can better understand your case and determine how we can help guide you to success.

Retain our firm so we may lead you through the legal process as quickly and painlessly as possible.

Currently Accepting New Clients

Real Estate Law Related Pages

Our Office

Port St. Lucie OFFICE

-

10026 S U.S. Hwy 1

Port St. Lucie, FL 34952 - 772-325-1860

- 772-673-3738

Client Testimonials

Simply enter your email below and join our growing community of informed individuals.